Why Invest in Cobalt

THE REVOLUTION IN ELECTRIC VEHICLES HAS STARTED

Investing in Cobalt

The cobalt market is a significant player among all industrial materials. While it may be difficult to determine the exact figures, analysts predict that the global cobalt market will reach a staggering $20 billion annually by the end of the decade. Though not on par with commodities like steel or coffee, it is still a vast market that presents numerous investment opportunities. Cobalt can be invested in through a variety of channels including individual securities and various types of funds, just like any other commodity. As an investor, the cobalt market offers a multitude of avenues to explore.

Investing in cobalt right now can be highly advantageous due to the unprecedented surge in demand for this metal. In recent years, the purchase orders for cobalt have skyrocketed as companies are striving to develop next-generation batteries and devices, specifically electric vehicles. In the current era, where governments worldwide are taking climate change seriously, the demand for these devices is only expected to increase. This is primarily because cobalt is an essential component in the production of lithium-ion batteries, which has led to a significant increase in its price. Therefore, investing in cobalt can prove to be a lucrative opportunity for producers and shareholders, who have already made a fortune in this blue gold rush.

Cobalt Price Performance

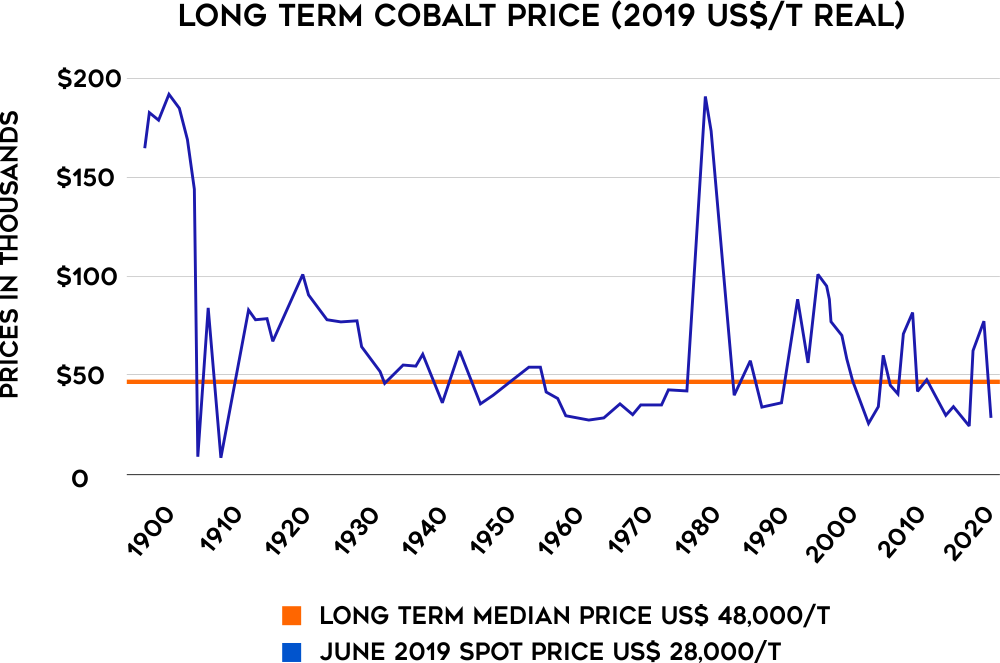

The price of cobalt has fluctuated dramatically during the previous century. Increasing demand, speculation about future needs, and intentional stockpiling of real cobalt in preparation for future demand have all contributed to price rises. A supply response from mines in the Democratic Republic of Congo ( DRC ) has fulfilled demand each time. With the electric vehicle revolution already established and rising demand for batteries expected, many analysts predict a new long–term median price for cobalt.

Figure 1 – Long Term Cobalt Price. Source: US Geological Survey, prices escalated to 2019 real by US CPI.

Cobalt Demand

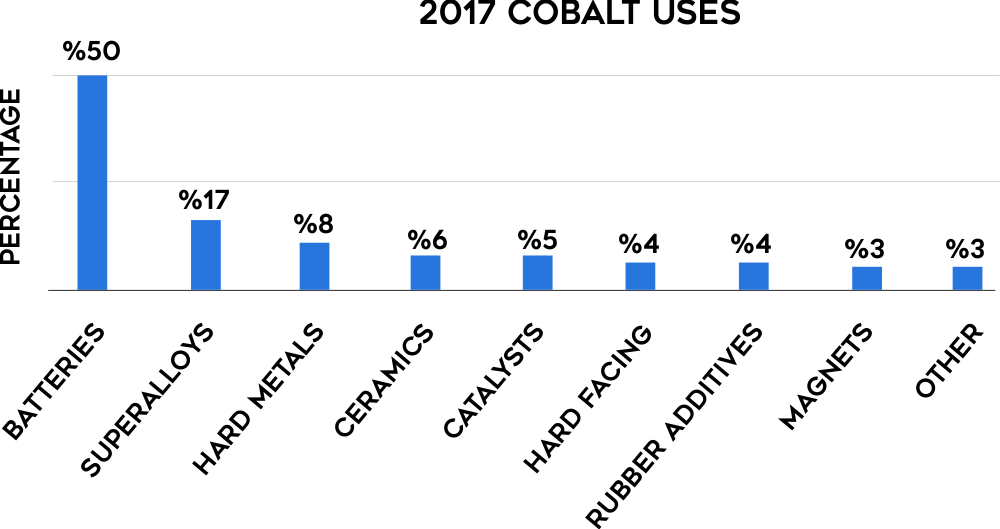

Cobalt is listed as a vital mineral in many countries. Superalloys for jet engines, magnets, carbides, and diamond tools are just a few of the applications that benefit from its unique mix of features. Batteries, catalysts, and pigments all contain cobalt.

Cobalt Supply

Cobalt is mined as a by-product of nickel and copper mining for 99% of the world's supply. These mines require a rise in nickel and copper prices in order for new cobalt to join the market. To liberate the nickel and cobalt metals from the minerals, most nickel laterite projects need high-pressure acid leaching (HPAL). HPAL typically necessitates a significant capital investment.

Figure 2 – Cobalt Uses. Source: Darton Commodities.

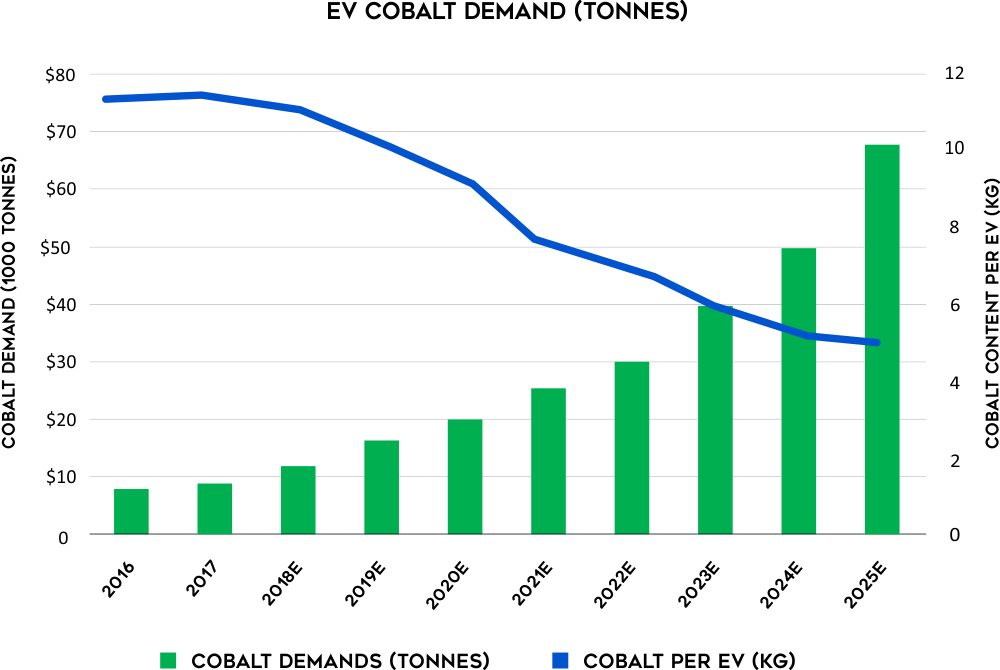

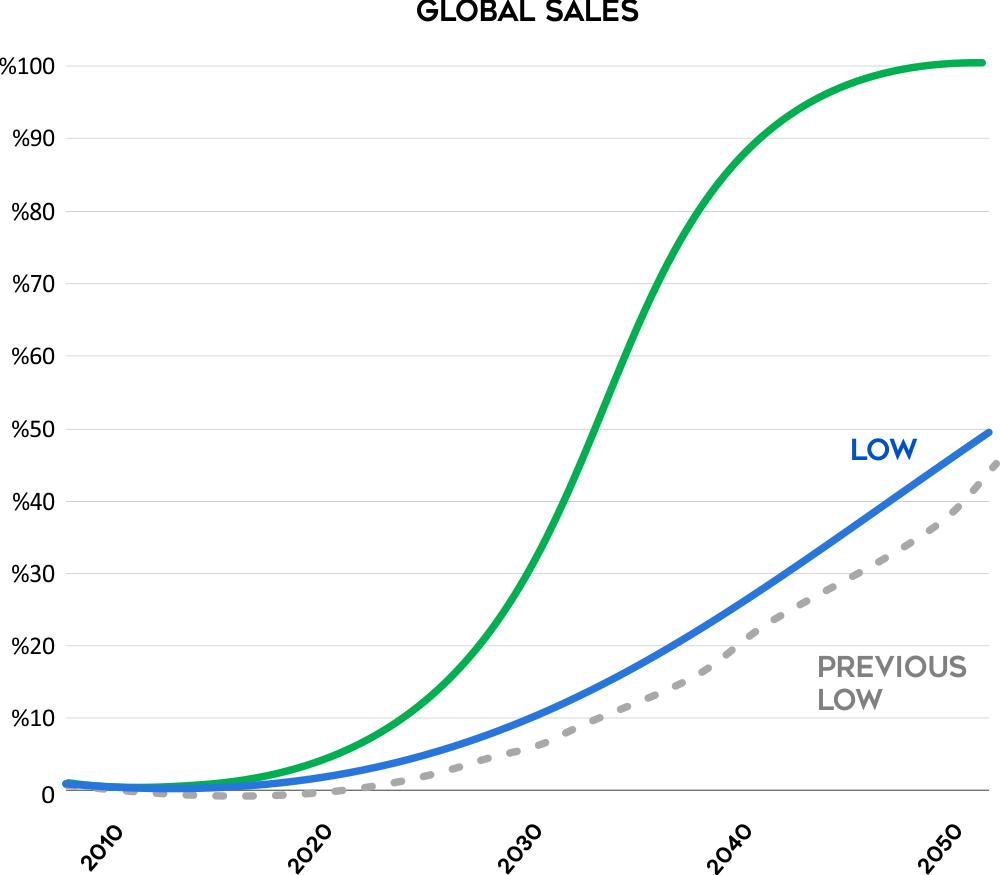

Figure 3 – Cobalt demand from electric vehicles; exponential despite substitution

Electric Vehicles

The electric vehicle revolution is driving up battery tonnages, which is driving up cobalt demand. Battery unit costs have dropped significantly as a result of technological advancements and economies of scale realized by battery mega-factories.

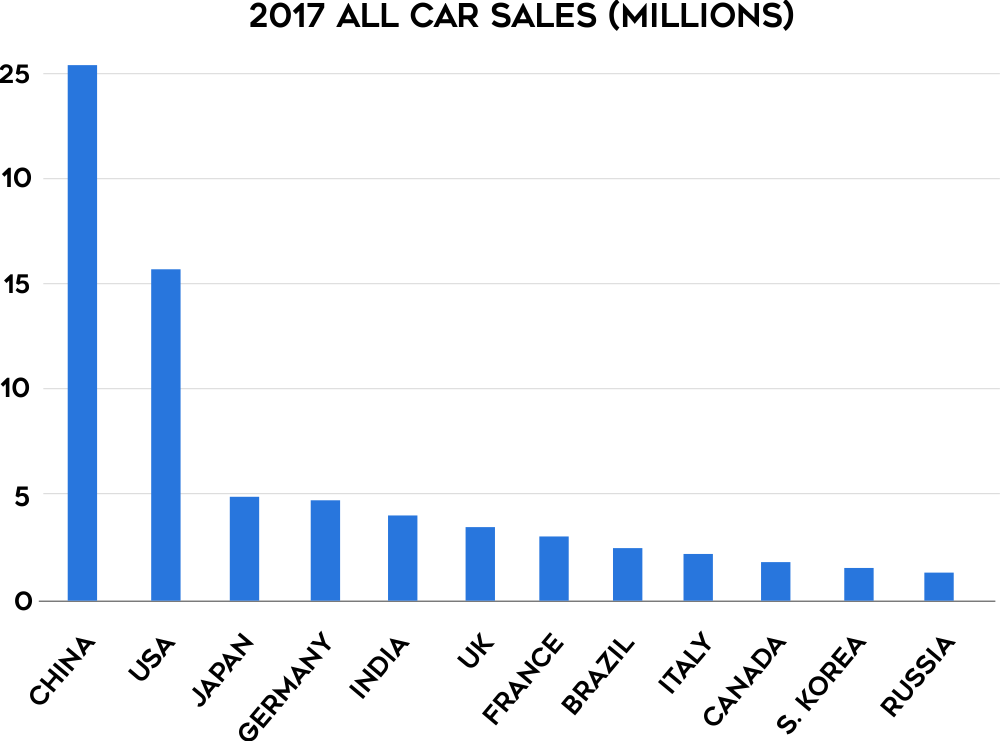

The decreasing unit costs of batteries have enabled electric vehicles to be priced at a level similar to traditional cars. In fact, in certain areas globally, electric vehicles are more cost-effective than their internal combustion engine counterparts when considering total ownership costs. Additionally, new electric car models have demonstrated a greater driving range, which has eliminated previous worries about range anxiety. This is particularly evident in the models that have been approved for sale in China.

The electric vehicle revolution has arrived, and it is no longer a matter of whether they are available, but how quickly they will be adopted by the general public. Electric vehicles are no longer seen as a novelty but as a practical and sustainable mode of transportation. With a variety of scenarios for their uptake, it is clear that electric vehicles are here to stay.

Figure 4 – Chinese electric vehicle sales

Automakers have responded with production achievements and policies of their own:

- Tesla – delivered 90, 700 units in Q4 2018

- BMW – 142, 000 EVs sold in 2018

- Renault Nissan – 400, 000 LEAFs sold to 2019

- Ford – will invest US$4.5 Bn in 2019-20

- Volvo – 50% EVs by 2025

- GM – 1, 000, 000 EV sales by 2026

- Toyota – 5.5 M EV sales by 2030

- Volkswagen – 22 M EV sales by 2030

Whichever way you look at it, the electric vehicle revolution is upon us. It is no longer a novelty and a question of if electric vehicles will arrive. It is not a question of when electric vehicles will arrive; they are her now. It is a question of how fast they will be adopted by the mass market. When BHP looks at the market, they see a range of possible realizations of how fast this uptake may occur ( Figure 5 ).

Figure 5 – forecast growth in electric vehicle sales